Summons for non payment of BID tax

This article gives details of all Summons for non-payment of the BID Levy sent out by the West Suffolk Council from 2020 to 2022 covering both Bury St Edmunds and Newmarket. The information provided here is derived from the Answers the West Suffolk Council gave to a Freedom of Information request, on the website, “What Do They Know”

QUESTION 1

The number of summonses issued through the Magistrate Court in order to seek a Liability Order for the failure to pay the BID Levy to West Suffolk Council (WSC).

Response from West Suffolk Council

Year ended 31 March 2020 – 74 Summons

2021 – 115 Summons

2022 – 71 Summons

QUESTION 2

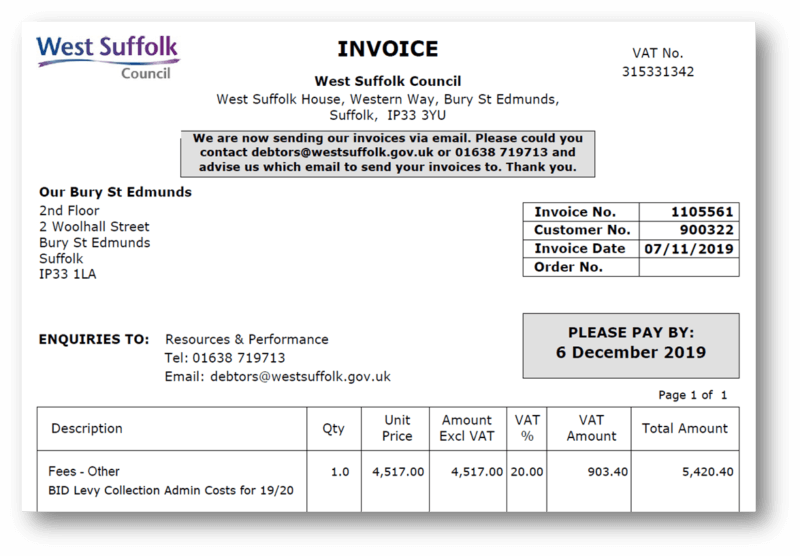

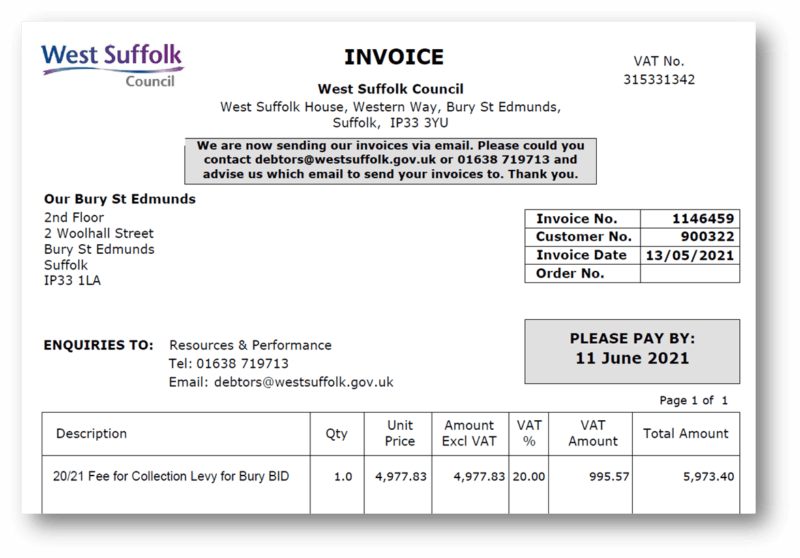

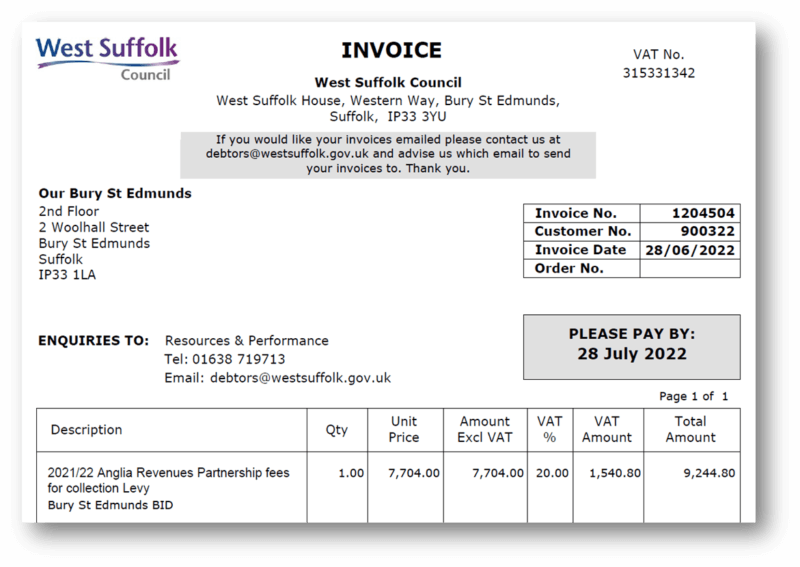

The amount invoiced by WSC to Our Bury St Edmunds BID (aka BSE BIDCO LIMITED) for the BID Levy collection costs to specify separately the amount invoiced in the year ended 31 July 2020, the year ended 31 July 2021 and the period from 1 August 2021 to the date of your reply.

Response from West Suffolk Council

The council invoiced the Bury St Edmunds BID based on the financial year ended 31 March for each of these years, as follows:

Year ended – Pre-VAT – VAT – Total – 31 March – Amount – @ 20% – Invoiced

2020 – £4,517.00 – £903.40 – £5,420.40

2021 – £4,977.83 – £995.57 – £5,973.40

2022 – £7,704.00 – £1,540.80 – £9,244.80

QUESTION 3

3. if Value Added Tax (“VAT”) is charged on the collection charges invoiced to Our Bury St Edmunds BID, and if so specify the rate of VAT charged.

Response from West Suffolk Council

The council charges VAT on the collection charges at the standard VAT rate of 20%.

QUESTION 4

Whether a VAT invoice is issued to Our Bury St Edmunds BID in relation to each collection charge invoice raised.

Response from West Suffolk Council

A VAT invoice is issued for each collection charge invoice.